July 21, 2025

Merck & Co. announced on July 9, 2025 that it will acquire U.K.-based Verona Pharma for around $10 billion, offering $107 per American Depositary Share. The transaction, expected to close in Q4 pending approvals, reflects Merck’s strategy to strengthen its respiratory portfolio under CEO Robert Davis.

This acquisition comes shortly after the FDA approved Ohtuvayre (ensifentrine) in June 2024, the first novel inhaled COPD maintenance medication in over twenty years. Ohtuvayre, launched in the U.S. in August 2024, reported $71.3 million in Q1 2025 net sales.

Diversification is a key driver here: Merck’s flagship oncology drug, Keytruda, will lose U.S. patent exclusivity in 2028. Acquiring Ohtuvayre offers a ready-made, in-market asset to offset that potential cliff.

COPD represents a significant medical and economic concern, affecting over 14 million U.S. adults and imposing roughly $50 billion annually in direct and indirect costs. The global COPD therapeutic market is expected to grow to over $30 billion by 2033. With over 8 million patients on maintenance therapy, roughly half continue to experience persistent symptoms, highlighting a critical unmet need.

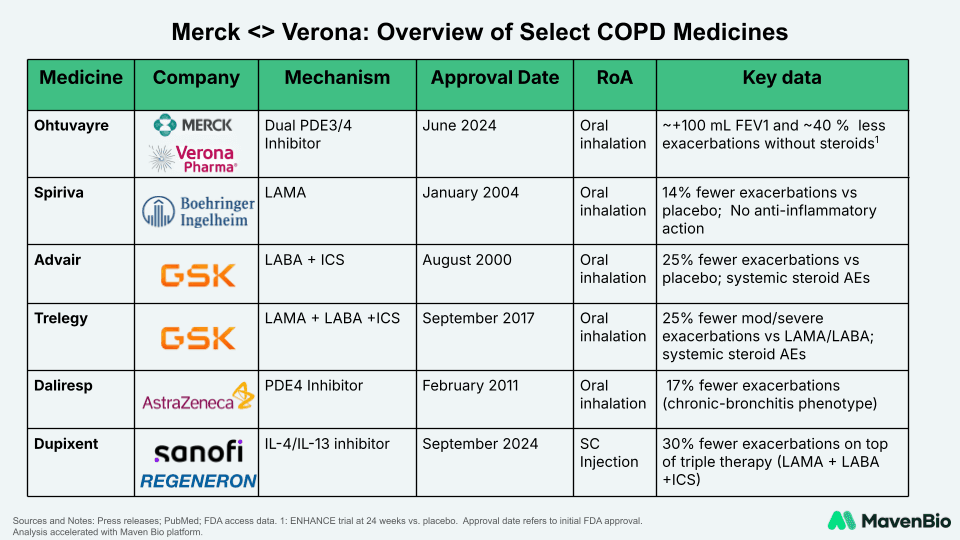

The current COPD treatment landscape comprises primarily of single-action bronchodilators, and combinations with inhaled corticosteroids, each showing incremental but often limited efficacy. Established therapies such as Spiriva (LAMA), Advair (LABA + ICS), and Trelegy (LAMA + LABA + ICS) demonstrate moderate reductions in exacerbations but carry risks like steroid-related adverse effects.

Ohtuvayre's dual PDE3/PDE4 inhibition mechanism distinguishes it significantly by delivering both bronchodilation and inflammation control without systemic steroids, positioning it uniquely alongside innovative biologics like Dupixent, which targets IL-4/IL-13 pathways in specific patient segments. This evolution underscores an industry-wide shift toward precision therapy to address the substantial unmet clinical needs in COPD.

The Verona Pharma acquisition delivers immediate commercial benefits, fills a long-standing innovation gap in COPD care, and helps Merck diversify ahead of Keytruda’s patent expiry. For patients, payers, and clinicians, this marks a meaningful shift toward more effective COPD treatment.