April 13, 2024

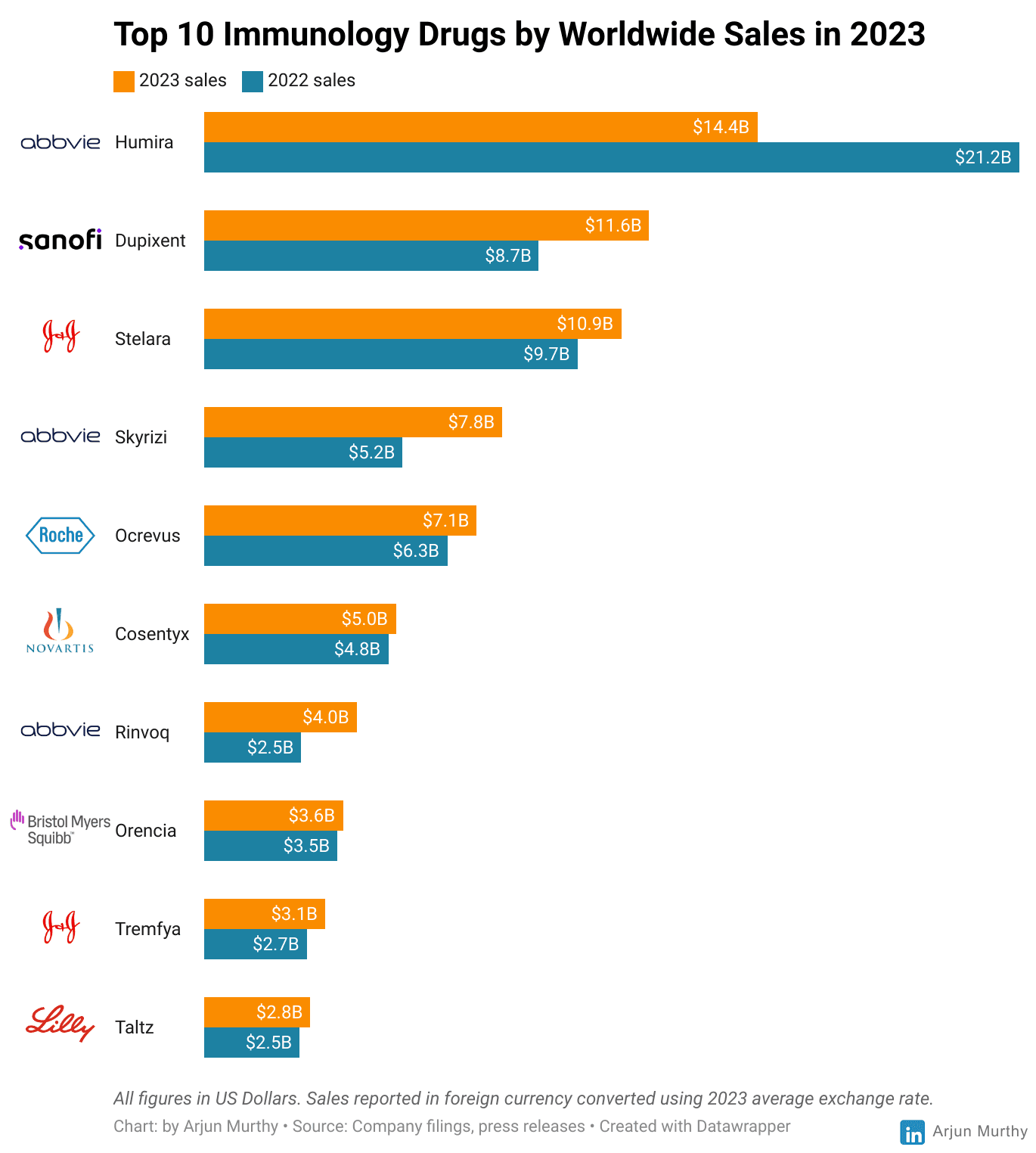

After several years as the world’s top selling medicine, AbbVie’s Humira began facing competition in earnest in 2023. Amgen’s Amjevita was the first of 9 biosimilar competitors that have launched in the US market.

AbbVie has been preparing for Humira’s LOE for years, and has a strong pipeline in immunology, including two other top 10 medicines, Skyrizi and Rinvoq, which together achieved more than $11B in sales, a ~$4B increase from 2022.

Sanofi’s Dupixent continued to set records and recently saw a new FDA approval for pediatric eosinophilic esophagitis.

It also had positive Phase 3 trial results for COPD, which is notable given if it gets to approval, it would be the first biologic treatment approved for that condition.

Finding out just how profitable a single blockbuster can be is often a challenge, but diving into Regeneron’s financials sheds light on just how profitable Dupixent is:

Since Sanofi and Regeneron are partners, Sanofi records revenue worldwide, while Regeneron reports only its share of profits, which is 50% on US sales, and between 35-45% on international sales.

In 2023, Regeneron recorded $3.1B in profits from its antibody collaboration with Sanofi – add on Sanofi’s share of profits, and Dupixent likely generates more than ~$6B in combined profit per year.

Dupixent’s patents run until 2031, so Sanofi and Regeneron have several years of strong growth ahead for their star franchise. Dupixent is Sanofi's top selling drug , ts success has enabled Sanofi

On the other hand, J&J’s blockbuster Stelara will face competition in 2025, notable given the drug accounts for ~20% of J&J’s pharma revenue.

One of the more exciting developments in immunology is the use of cell therapies for autoimmune conditions, particularly lupus.

While there is a long way to go before commercialization, early studies have yielded impressive results, which leaves open the possibility that one day, some of the top 10 might be cell therapies.