April 6, 2025

Why HAE Matters

Hereditary angioedema (HAE) is a life-altering, ultra-rare genetic disorder that can cause severe, unpredictable swelling attacks in various parts of the body—sometimes with life-threatening consequences when the airways are involved. Despite the availability of prophylactic therapies such as Takhzyro, Haegarda, Cinryze, and Orladeya, and on-demand rescue treatments like Firazyr and Berinert, patients still face significant burdens. They often contend with breakthrough swelling episodes, the discomfort of frequent or painful injections, and the logistical challenges posed by cold-chain storage requirements. In many instances, these issues affect patients’ quality of life, setting the stage for the next wave of innovation.

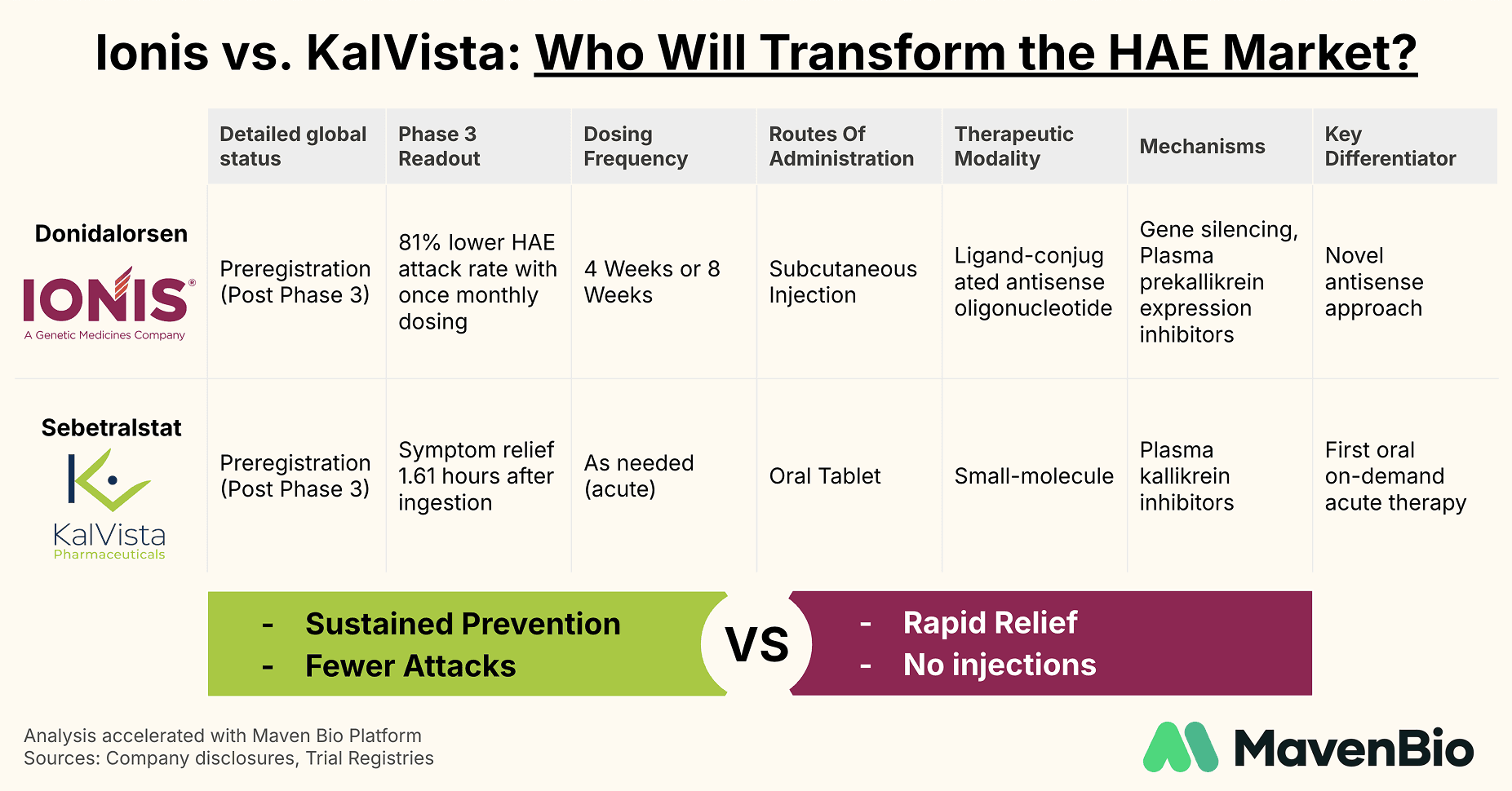

Ionis vs. KalVista: Disruptive or Incremental Gains?

Two companies have recently gained considerable attention for their efforts to improve HAE treatment.

Ionis Pharmaceuticals is targeting long-term prevention with donidalorsen, a ligand-conjugated antisense therapy designed to reduce prekallikrein production at the source. In clinical trials, monthly injections of donidalorsen showed an 81% reduction in attack frequency, while bi-monthly dosing demonstrated a 55% reduction. These results suggest a superior prophylactic approach compared to established therapies; however, Ionis faces a commercial challenge in convincing physicians and payers to adopt another injectable therapy, particularly in an era where biologics already command substantial prices. The potential advantage—a robust safety and efficacy profile with convenient, autoinjector-based administration—could help overcome these barriers if real-world data confirm donidalorsen’s benefits.

KalVista Pharmaceuticals is addressing acute treatment needs with sebetralstat, an oral plasma kallikrein inhibitor. In its Phase 3 KONFIDENT trial, sebetralstat reduced symptom onset to 1.61 hours compared to 6.72 hours with placebo, underscoring the value of a rapid and needle-free therapy. As a result, sebetralstat could fill a notable quality-of-life gap for patients who experience breakthrough attacks, even if they are already on prophylaxis. Instead of replacing existing therapies, sebetralstat’s ease of use and quick onset are designed to complement prophylaxis and help patients regain a sense of control during unpredictable swelling episodes.

Key Catalysts to Watch

Both donidalorsen and sebetralstat have recently completed Phase 3 trials. Regulatory decisions in the United States are expected in 2025, setting up a likely head-to-head in the market. While Ionis will emphasize the sustained attack reduction made possible by donidalorsen’s monthly or bi-monthly dosing regimen, KalVista will highlight the immediate symptom relief from an oral, on-demand therapy.

From a commercial standpoint, the two companies are taking fundamentally different routes. Ionis is betting on next-generation prophylaxis, using its antisense technology to disrupt the kallikrein pathway. KalVista, meanwhile, is banking on the idea that ease of administration, absence of injections, and a robust reduction in symptom onset time will bring broad acceptance for sebetralstat as a must-have rescue therapy.

Moving Forward

The HAE market is becoming a proving ground for next-generation rare disease therapies. Each approach—proactive prevention through antisense inhibition vs. convenient, rapid oral on-demand treatment—addresses distinct unmet needs. Ultimately, acceptance by patients, payers, and physicians will depend on compelling clinical data, real-world outcomes, and how each therapy impacts patients’ daily lives.

As companies unveil new data and seek regulatory approvals, the focus will remain on efficacy, safety, ease of administration, and total healthcare cost. Whichever strategy resonates most strongly across these dimensions has the potential to reshape the competitive landscape—and significantly improve care for individuals living with HAE.