Gilead’s Q2 2025 Highlights

August 15, 2025

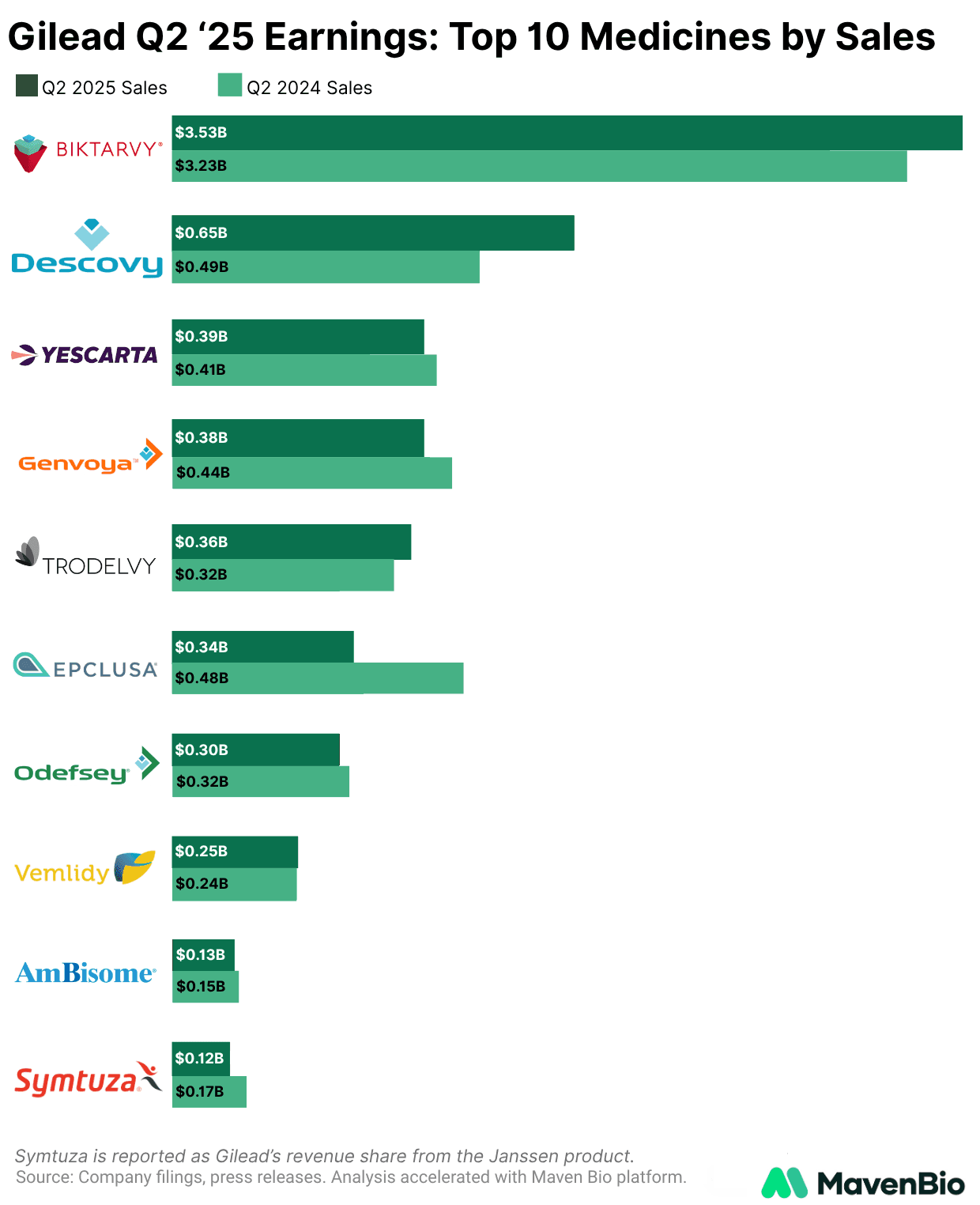

Gilead reported Q2 2025 earnings last week, announcing total revenue of approximately $7.1 billion and non-GAAP EPS of $2.01. It raised full-year product sales guidance to $28.3-28.7 billion, driven by continued strength in its core HIV franchise and double-digit growth from its oncology drug Trodelvy, which together helped offset an expected decline in sales of COVID-19 drug Veklury and softer performance in its Liver Disease and cell therapy segments. Against this backdrop, we outline near-term catalysts across the HIV and oncology franchises.

In HIV, the franchise generated $5.1 billion in Q2 revenue, up 7% year over year, supported by both treatment and prevention.

In HIV Prevention (PrEP), the FDA approved Yeztugo as the first twice-yearly PrEP option, and in late July the EMA’s CHMP issued a positive opinion under accelerated assessment, setting up a potential EU approval later this year. In the US, CMS has clarified Medicare coverage for the in-clinic therapy, which should significantly reduce payer friction.

Gilead projects mid-teens growth for the U.S. PrEP market, which now comprises four products: generic once-daily Truvada, Gilead’s daily Descovy, ViiV’s every-two-months injectable Apretude, and Gilead’s twice-yearly Yeztugo.

Despite some possible cannibalization of Descovy’s >40% market share, Gilead projects Yeztugo will expand the overall market by addressing adherence barriers of daily pills and pressure Apretude’s less convenient dosing schedule.

Biktarvy remains the treatment anchor, delivering $3.5 billion in sales and holding roughly 51% of the U.S. treatment market. It also benefited from a July FDA label expansion to include patients with prior ART who are not virologically suppressed.

This new indication directly challenges ViiV’s long-acting and two-drug competitors: Biktarvy can capture patients before they qualify for the long-acting injectable Cabenuva, which requires prior viral suppression.

In addition, a once-daily bictegravir/lenacapavir combination is already in Phase 3, aiming to provide a simpler, high-barrier regimen that sustains switch momentum, protects first-line share against two-drug and long-acting rivals, and extends the HIV franchise runway into the next decade.

In oncology, Trodelvy, Gilead’s flagship ADC, recorded $364 million in Q2 sales, up 14% year over year, as the company prepares for first-line expansion in PD-L1-positive metastatic triple-negative breast cancer (mTNBC). The ASCENT-04 study showed Trodelvy plus Keytruda reduced the risk of progression or death by 35% versus Keytruda plus chemotherapy in mTNBC, with regulatory filings planned for the second half of 2025.

If approved, Trodelvy would compete with the current Keytruda-plus-chemotherapy standard of care and with AstraZeneca/Daiichi Sankyo’s advancing datopotamab deruxtecan, setting up a competitive battle among next-generation ADCs.

Unlock purpose-built AI research for your team

Stop burning hours on manual data hunts — let Maven Bio do the heavy lifting so you can focus on the strategic decisions that drive your business forward.

Schedule a Demo